Exploring Futu on Bloomberg · A Fintech Research Note

A research note that investigates Futu Holdings Ltd (Nasdaq: FUTU) based on its Bloomberg investor presentation deck from November 2024.

The analysis covers key aspects: company overview, product and platform, revenue model, technology stack, recent financial results, competitive landscape, banks’ positioning, and future trends.

Scope: positioning and products, operating stack, financial highlights, peers, banks’ stance, and forward trends. The tone remains observational and restrained.

Company overview

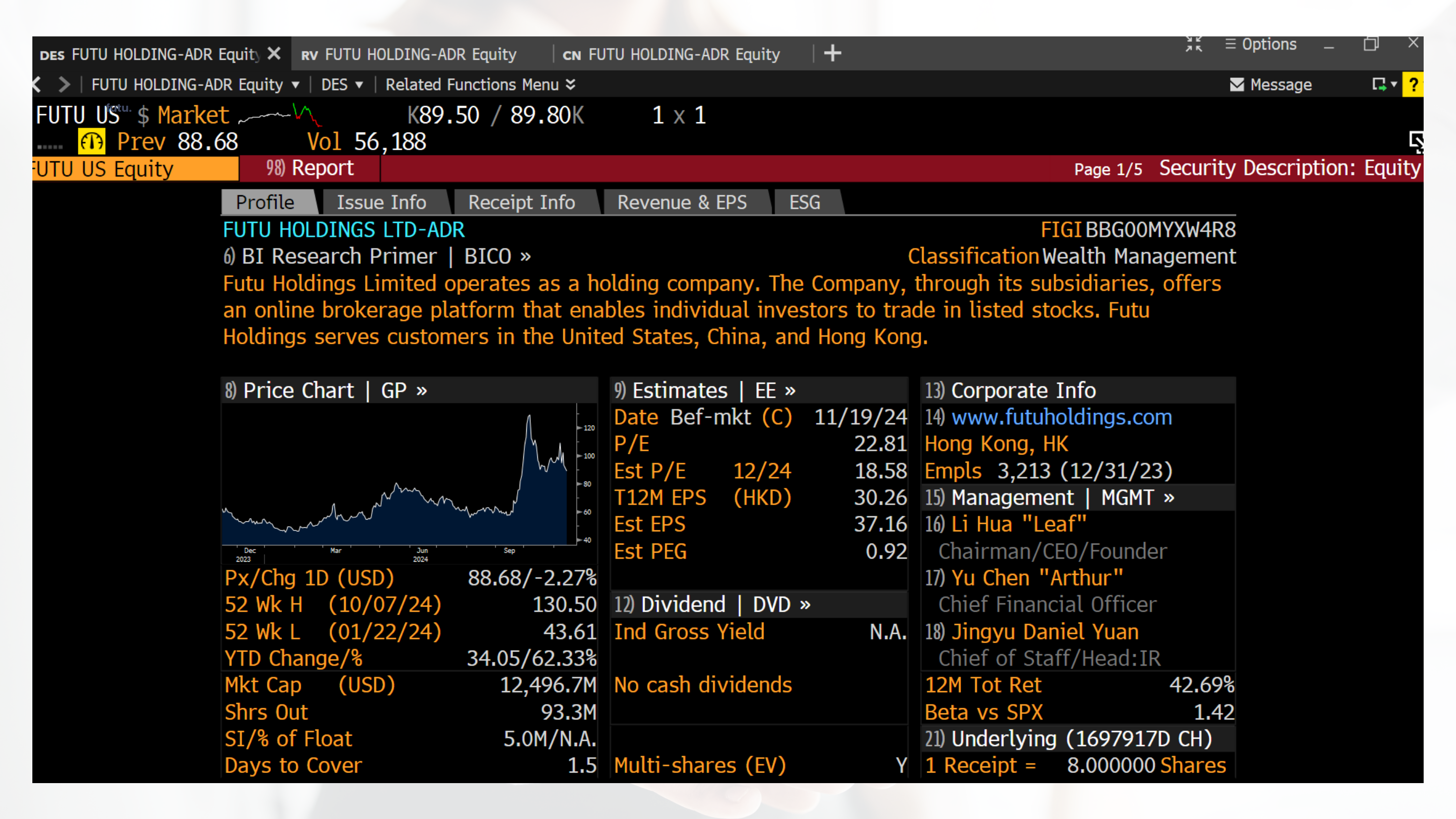

Futu is presented as a digital brokerage operating two flagship platforms: Futu NiuNiu (mainland‑facing) and moomoo (international). The deck cites 24M+ registered users and roughly 2.2M paying clients, with a footprint spanning Hong Kong (HQ), the US, and Singapore. Market coverage includes US, Hong Kong, and China A‑shares.

The platform serves both investors and issuers. On the investor side: trading, clearing, margin financing, and wealth solutions. On the issuer side: ESOP support, IPO distribution, and IR/PR tools. A reasonable mental model is a two‑sided marketplace where retail flows and corporate needs meet on shared rails.

Product, platform, brand

Two visuals underline the product emphasis on real‑time data and consolidated tools. The graphs do not attach metrics; they frame intent: surface markets, orders, and research in a way that reduces friction for self‑directed investors.

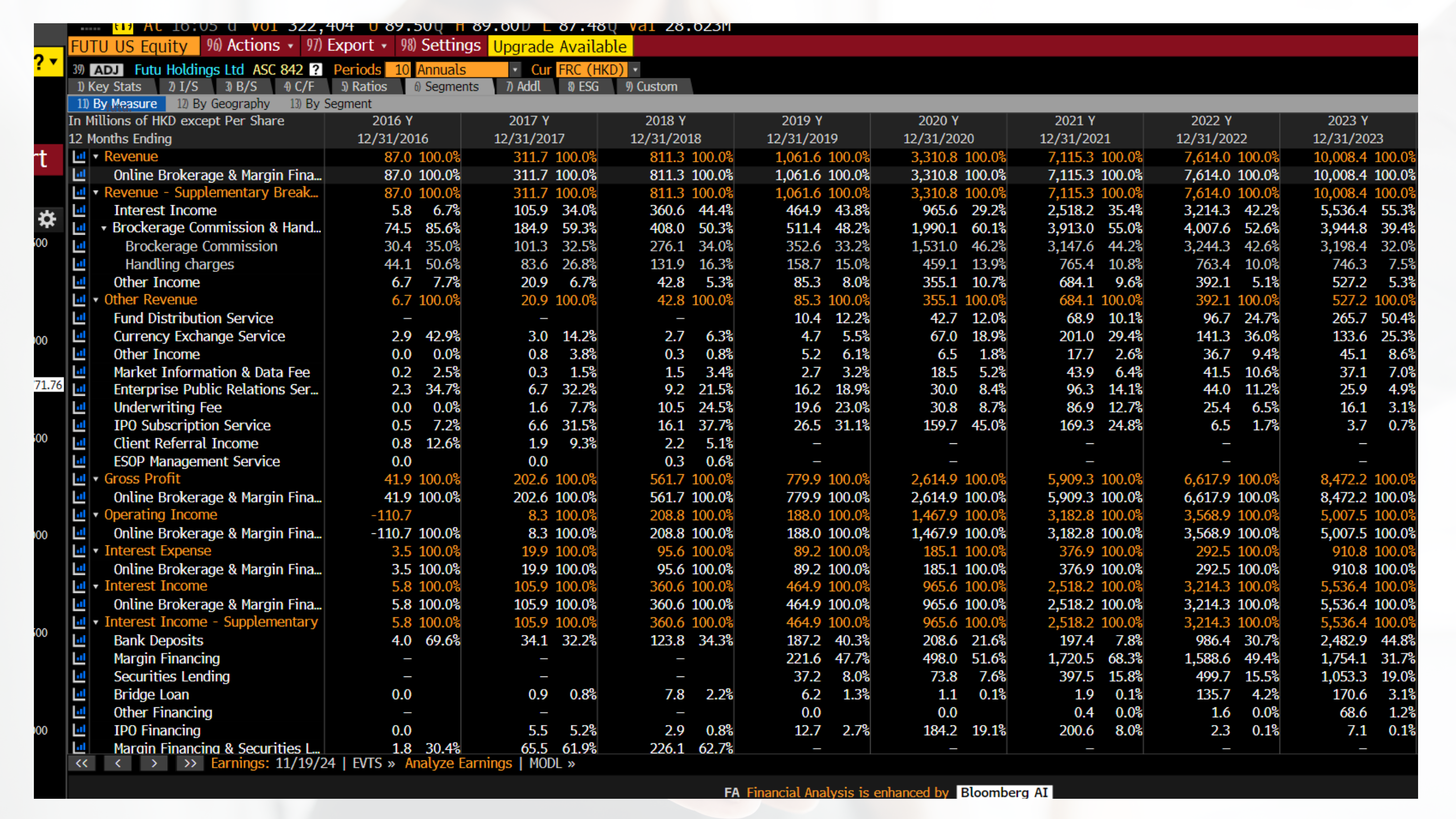

Revenue model

Three components are highlighted:

- Brokerage commissions and fees — activity‑linked.

- Interest income — mainly margin financing and securities lending.

- Other income — wealth management and corporate services (e.g., ESOP).

The structure seeks to balance trading cyclicality with financing and service lines that buffer volatility.

Technology and operating stack

The deck emphasizes proprietary systems in trading, clearing, and risk control, plus the use of data and AI in personalization and risk assessment. The stated impact focuses on lower latency, faster processing, and more tailored experiences. The message is straightforward: infrastructure control supports product reliability; modeling supports relevance.

Recent results and activity

For Q3 2024, the total revenue of $442.3M (up 29.6% year over year) and $180M in net profit (up 20.8%). A Nasdaq collaboration in April 2024 offered Level 2 TotalView quotes for three months, aligning product incentives with acquisition and activation. The user base remains large; paying clients are the quality filter.

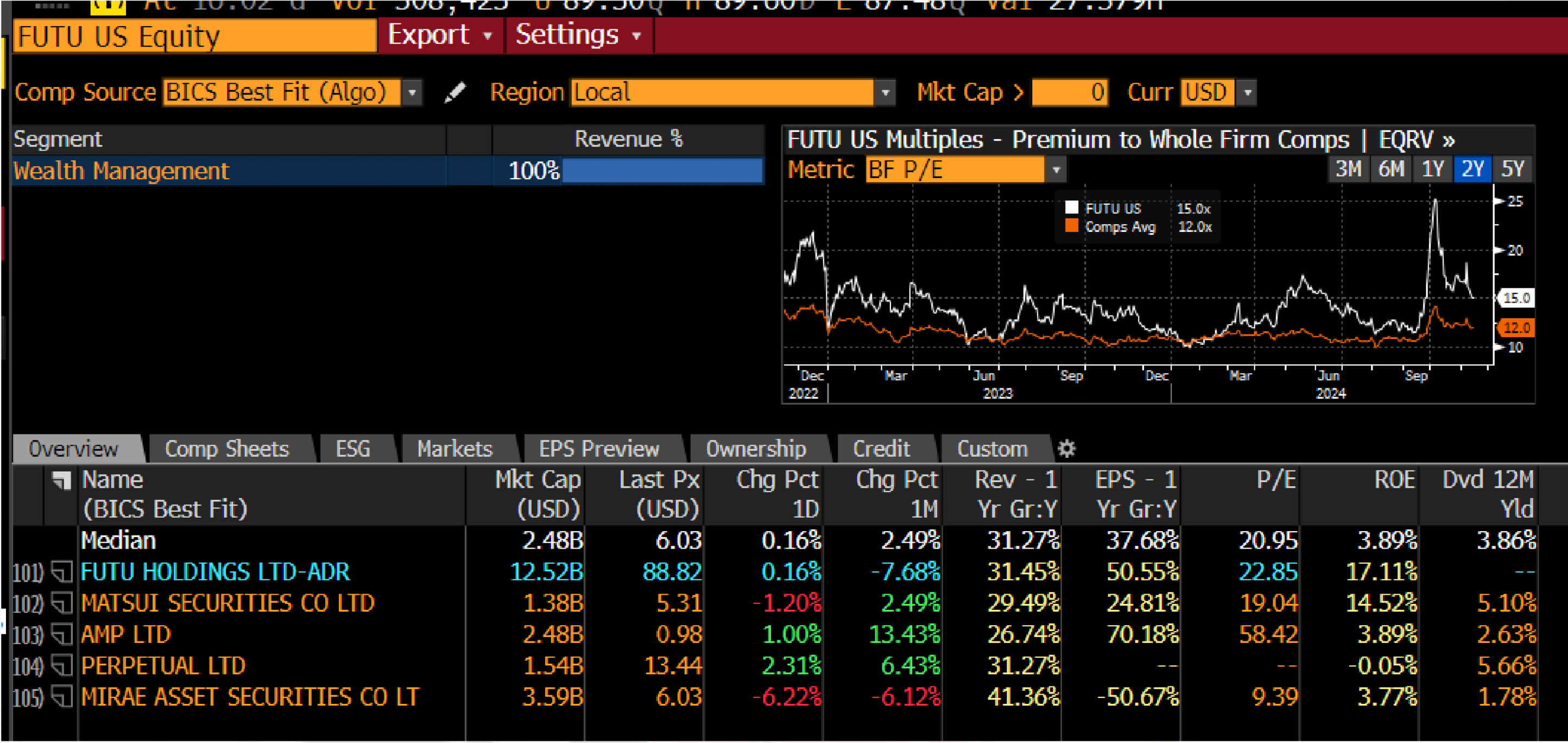

Competitive landscape

Peers referenced include Tiger Brokers, Interactive Brokers, and Robinhood. The deck’s stance is that Futu competes well in Asian markets, leaning on proprietary tech and AI‑led personalization. While the relative valuation visual appears as context, the slides do not enumerate ratios in text; no numeric inference is made here.

A practical reading is that the category converges on similar themes (experience quality, wealth adjacencies, data‑driven iteration) and diverges on market focus, monetization mix, and regulatory posture.

Banks’ positioning and response

Traditional banks are described as both competitors (retail, wealth) and partners (distribution, data, UX). Two motions are noted: improved in‑house digital trading and wealth; and collaboration with fintech platforms where partnership reduces time‑to‑capability without sacrificing prudential design.

Trends: regulation, technology, demand

Three vectors frame the forward view:

- Regulation and compliance: tighter data‑privacy rules and cross‑border requirements.

- Technology: AI/ML for automation, customer insight, and risk; blockchain where transparency and settlement efficiency matter.

- Demand: self‑directed investors and mobile‑first expectations, with real‑time information at the center of perceived value.

These forces do not always align; the operating challenge is to reconcile them without diluting proposition clarity.

Synthesis

Within all this, the scope reads broader than a narrow broker: execution plus financing, wealth, and corporate services. Differentiation is attributed to infrastructure control and model‑driven personalization. Banks sit on both sides of the table depending on the lane. Future themes — AI, selective blockchain, tighter regulation, changing consumer behavior — are framed as constraints and levers rather than slogans.

Private note

No doubt, Futu is an interesting case study in digital brokerage and has made notable strides in user acquisition and platform development.

Besides the information I got from Bloomberg Terminal, I believe there are still some critical factors worth investigating further: how much benefit does Futu get from as a channel between mainland China and international markets? Because we know that there are tremendous demand from Chinese retail investors to access overseas markets, and Futu seems to be well positioned to capture that flow. What’s gonna happen if regulatory environment changes? We will see.

In the end, to be honest, there are a lots of knowledge I still need to learn in finance, e.g., company valuation, financial modeling and even statement analysis.