Chapter III · Banks vs. New Financial Intermediaries

The professor started that day’s lecture with a simple question:

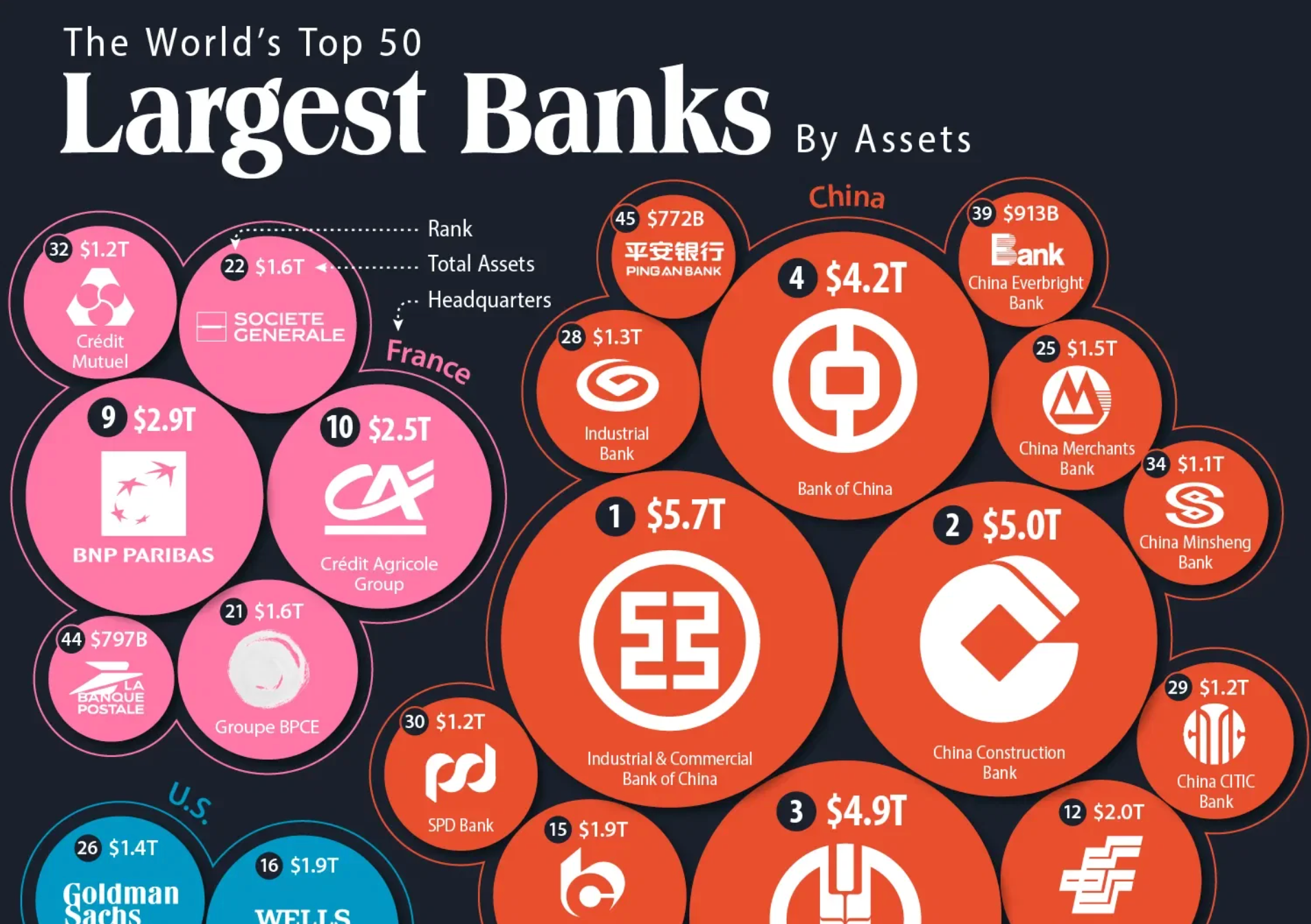

“Do you know which are the ten largest banks in the world?”

Well,

Someone guessed: JPMorgan? HSBC? Maybe Deutsche Bank?

The professor pulled up a slide —

and most of the names were Chinese.

ICBC, China Construction Bank, Agricultural Bank of China, Bank of China…

Their names showed up everywhere in my hometown.

For a course that spent weeks talking about FinTech disruption and new intermediaries,

it was a surprising reminder that the old giants still rule the mountain.

So what, exactly, have these “new” players changed?

The paradox of power

Banks remain the biggest financial engines on earth.

They hold the assets, the licenses, and — most importantly — the trust.

While startups experiment with apps and algorithms,

traditional banks continue to shape the macro landscape.

But something subtle has shifted.

The center of gravity — not in size, but in experience.

FinTech didn’t steal the balance sheet;

it stole the conversation.

How FinTech changed the interface, not the core

Think about payments, savings, lending.

They still rely on regulated infrastructure,

but the user experience now belongs to technology firms.

We compared Revolut to BNP Paribas.

Same function — move money, show balance, manage spending —

yet the emotional response couldn’t be more different.

BNP feels like a place; Revolut feels like a tool.

And maybe that’s the difference between banking and being banked.

When competitors became partners

Instead of a full-blown rivalry,

what emerged was a quiet partnership.

Open banking APIs, shared data models, white-label services —

the new intermediaries didn’t overthrow the system;

they extended it.

Banks learned to look more digital.

FinTechs learned to look more reliable.

Somewhere between the two, a new hybrid form appeared —

half institution, half platform.

What really changed

If you zoom out, the biggest shift isn’t structural — it’s cultural.

Finance used to be something you entered:

a building, a branch, a process.

Now it’s something that follows you —

a screen, a notification, a frictionless tap.

The intermediation didn’t disappear;

it just dissolved into the background.

Maybe that’s what real innovation looks like:

when it becomes invisible.

A small thought to end with

To be honest, it’s hard to distinguish modern finance and fintech anymore.

Banks have adopted technology at their core,

and fintechs have embraced regulation as a necessity.

The lines blur, and what matters more is the experience they create.

How strange that the world’s largest financial institutions

can coexist with the smallest, fastest apps on our phones.

They operate at different speeds,

but somehow, on the same network of trust.

Maybe that’s the story of modern finance:

the giants hold the system,

and the newcomers keep it alive.